what chinese goods are subject to us tariffs

In early on 2018, the Trump administration commenced a series of tariff deportment that raised duties on China's exports to the United states successively over the side by side two years. To each round of these The states tariffs, China'south government responded with retaliatory duties against goods imported from the U.s.a.. Past September 2019, both sets of tariffs had been extended to cover the vast majority of products traded between the ii countries.1 These tariffs negatively impacted bilateral trade flows (Amiti et al. 2019, Fagjelbaum et al. 2019, 2020) and have go a persistent thorn in the side of US-China relations.

Did the US tariffs on Chinese exports have a negative touch on economic activity within China, and if and then by how much? As well, did Communist china'southward retaliatory tariffs bear upon domestic production, given that these would in principle have raised the cost of inputs sourced from the US?

There is now a fairly large body of empirical evidence on the effects of this 'tariff war' on the US economy. Researchers have documented that there has been almost complete pass-through of the tariff burden to U.s. prices (Amiti et al. 2019, Cavallo et al. 2021). The tariffs have besides adversely affected domestic consumption (Waugh 2019), investment (Amiti et al. 2020), and employment (Flaaen and Pierce 2019).

By comparing, less is known nearly the impact (if any) that the tariff war has had on Prc'south economy, hence motivating the two research questions posed in a higher place. This is non due to a lack of interest in these questions, simply rather reflects constraints on data availability. In particular, China's statistical agencies do non regularly disembalm data on output and employment at the subnational level or for detailed industries; such information as practice go available are often subject to reporting lags.2

Given these information limitations, nosotros turn to satellite readings of dark-fourth dimension luminosity. Measures of night lights take come into increased use as a proxy for the intensity of human-generated activity in otherwise information-scarce settings. The economic growth and evolution literatures accept shown that night lights are strongly correlated with more than conventional measures of economic performance such as GDP (Chen and Nordhaus 2011, Henderson et al. 2012). Night lights data have also been used more recently to study the curt-run responses to macroeconomic shocks beyond locations within a country (Chodorow-Reich et al. 2019).three The dark lights information afford us a caste of spatial resolution – at the level of 11km-past-11km filigree cells – that would be hard to reach with other sources of data. The satellite readings are as well less subject to concerns most data manipulation.

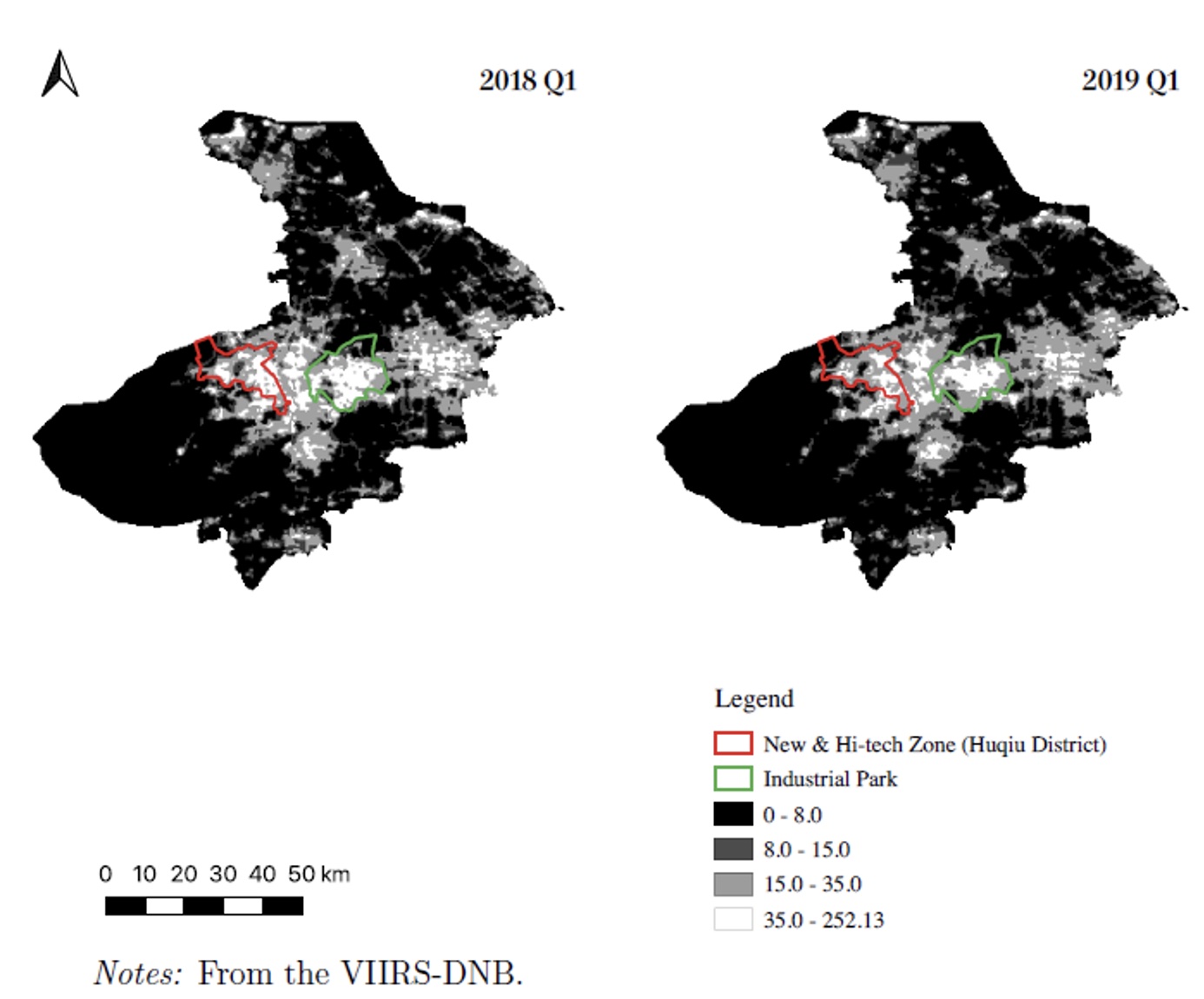

Figure 1 provides an instance of the variation across locations that the night lights data reveals. The figure plots night-time luminosity in the prefecture-urban center of Suzhou, in Q1/2018 and Q1/2019 respectively. Night lights dimmed to a greater extent in the ii highlighted regions – the Huqiu New & Hi-Tech Zone and the Suzhou Industrial Park – relative to the rest of Suzhou.4 The decrease in night light intensity was greater in these two manufacturing zones that feature a high export-intensity, suggesting a possible link to the tariff war. If export demand took a striking from the Us tariffs, the resulting wrinkle in product and in labour demand would reduce lights emitted from manufacturing plant night-shifts and from the worker dormitories often situated in close proximity inside Mainland china's industrial areas.

Figure 1 Night light intensity in Suzhou in Q1/2018 and Q1/2019

More than formally, we perform this assay using a console dataset of quarterly observations assembled for the nearly 100,000 grid cells that span mainland Mainland china. To credibly isolate the effects of the tariffs, nosotros implement a shift-share empirical strategy. To assess the impact of the US tariffs on Chinese exporters, we construct a measure out of a grid location'south exposure to these tariffs that makes employ of the limerick of filigree-level exports prior to the tariffs. Intuitively, locations within China would be more than exposed if they initially specialised in selling products to the United states of america that were subsequently subjected to larger tariff increases. At the same time, we construct an analogous measure of a grid location'southward exposure to China's retaliatory tariff actions, using the composition of pre-tariff imports of intermediate inputs and capital appurtenances, as well every bit the product-level retaliatory tariffs that were subsequently imposed. The empirical strategy we pursue requires detailed information on the structure of China's trade flows at the grid level. We construct this past geo-locating firms in the 2016 Chinese customs data to filigree locations using web-based mapping services (Google Maps and Amap).

Our central result is that locations within Mainland china that were more than exposed to the United states tariffs experienced a larger decrease in nighttime lite intensity, pointing to a contraction in local economic activeness (Chor and Li 2021). These findings are obtained using a specification that includes filigree and prefecture-time fixed effects. Nosotros moreover control extensively for pre-trends that might be associated with other initial grid characteristics, such as openness to trade (initial grid exports per capita, grid intermediate imports per capita) and overall economic development (initial grid hateful night lights intensity). We further bear witness that our findings are robust when controlling for a location's possible exposure to contemporaneous commutation rate movements or VAT adjustments.

By contrast, nosotros find that exposure to Prc'south retaliatory tariffs had an insignificant event on grid-level night lights. Nosotros present some suggestive evidence for why this was the case. Mainland china'south reductions to its nigh-favoured nation (MFN) tariff rates starting time some of the bite of the retaliatory tariffs. Chinese importers too appear to accept turned to alternative country sources for their inputs. Last just not least, there is the possibility that Chinese firms substituted toward domestic inputs, although we lack direct data to verify this.

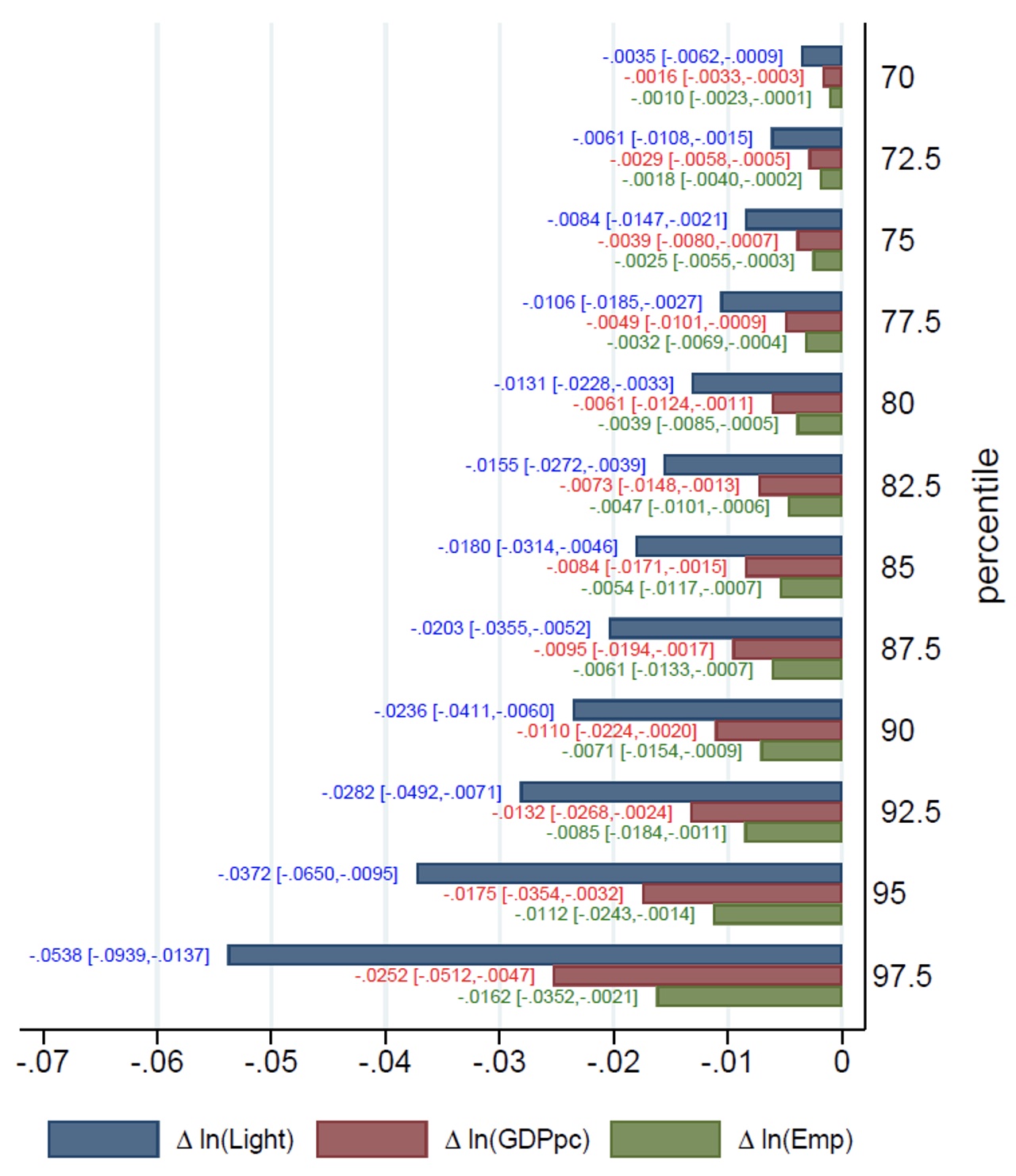

As a second footstep in our assay, nosotros map the higher up touch on on dark lights intensity to more conventional economical outcomes – specifically, Gdp per capita and manufacturing employment. To do so, we follow the statistical model in Henderson et al. (2012) and gauge the required structural elasticity that maps changes in night lights to changes in Gdp per capita (respectively, manufacturing employment), using prefecture-level data from the Chinese City Statistical Yearbook from 2012-2016. With these elasticities, we can then compute the inferred changes in the respective economical outcomes that matches the changes in night light intensity induced by the US tariff shocks.

Figure two summarises this inferred impact of the US tariffs across filigree locations. The grid cells are first ordered in terms of the severity of exposure to the Usa tariffs and grouped into population-weighted percentile bins. We notice that the negative impact of the US tariffs was highly skewed across locations. Up to 70% of China's population experienced cypher or minimal direct exposure to the United states tariffs. On the other hand, the tail ii.v% of China's population that was virtually directly exposed saw a 9.1 percent bespeak US tariff shock; this translates to a ii.52% wrinkle in GDP per capita and a i.62% reduction in manufacturing employment relative to unaffected grids. The grid cells in this most tariff-exposed bin were not clustered solely in coastal regions; instead, these cells could be found in close to 2-thirds of China's prefectures.

Figure 2 Furnishings of the export tariff shock across population percentile bins

To sum upwards, our findings confirm that the tariffs enacted past the U.s.a. on exports from Prc had a negative impact on economical performance in the curt run. Several open questions with policy implications remain. To what extent will the continued awarding of these tariffs complicate and dull down the recovery of China'due south economy from the Covid-19 pandemic? Too, what are the longer-term consequences of these tariffs, as their impact on firms' investment decisions play out more fully?

References

Amiti, G, S J Redding, and D Weinstein (2019), "The affect of the 2018 trade war on U.S. price and welfare", Journal of Economical Perspectives 33(4): 187-210.

Amiti, G, Due south H Kong, and D Weinstein (2020), "The consequence of the U.S.-Mainland china trade war on U.S. investment", NBER Working Paper No. 27114.

Cavallo, A, Yard Gopinath, B Neiman, and J Tang (2021), "Tariff pass-through at the border and at the store: Evidence from US trade policy", American Economic Review: Insights 3(1): nineteen-34.

Chen, X and W D Nordhaus (2012), "Using luminosity data as a proxy for economic statistics", Proceedings of the National Bookish of Sciences 108(21): 8589-8594.

Chodorow-Reich, One thousand, Thou Gopinath, P Mishra, and A Narayanan (2019), "Cash and the economic system: Evidence from India's demonetization", Quarterly Journal of Economics 135(1): 57-103.

Chor, D and B Li (2021), "Illuminating the effects of the US-Cathay tariff war on China's economic system", NBER Working Newspaper No. 29349.

Cui, C and L South-Z Li (2021), "The consequence of the Usa-People's republic of china merchandise war on Chinese new firm entry", Economic Letters 203: 109846.

Donaldson, D and A Storeygard (2016), "The view from above: Applications of satellite data in economics", Journal of Economic Perspectives 30(4): 171-198.

Fajgelbaum, P D, P K Goldberg, P J Kennedy, and A K Khandelwal (2019), "The return to protectionism", VoxEU.org, 7 November.

Fajgelbaum, P D, P K Goldberg, P J Kennedy, and A K Khandelwal (2020), "The return to protectionism", Quarterly Periodical of Economic science 135(ane): 1-55.

Flaaen, A and J Pierce (2019), "Disentangling the effects of the 2018-2019 tariffs on a globally connected U.South. manufacturing sector", Working Newspaper.

He, C, K Mau, and M Xu (2021a), "Trade shocks and firms hiring decisions: Bear witness from vacancy postings of Chinese firms in the trade state of war", Labour Economics 71: Commodity 102021.

He, C, K Mau, and M Xu (2021b), "The effects of the US-China trade war on firms' vacancy postings", VoxEU.org, fifteen July.

Henderson, J V, A Storeygard, and D N Weil (2012), "Measuring economical growth from outer infinite", American Economic Review 102(2): 994-1028.

Waugh, M Eastward (2019), "The consumption response to merchandise shocks: Evidence from the U.s.a.-China trade war", NBER Working Newspaper No. 26353.

Endnotes

1 At the height of the 'tariff war' in September 2019, US tariffs on China had increased by 20.7 percentage points for the average HS half dozen-digit product; these affected 14.2% of the 2017 value of Communist china's total exports. The retaliatory tariffs put in place by China averaged 16.half-dozen percentage points; these affected 5.vi% of the 2017 value of China'due south total imports.

ii Several existing studies on the tariffs' impact on China have similarly turned to the utilise of novel information sources: He et al. (2021a, 2021b) examine data on online vacancy listings, while Cui and Li (2021) wait at records of new visitor registrations.

three See Donaldson and Storeygard (2016) for a survey on the use of satellite-based information in economic science research.

iv The change in hateful log nighttime lights was -0.105, -0.085, and -0.067 for the New & Hello-tech Zone, the Industrial Park, and the residue of Suzhou, respectively.

Source: https://voxeu.org/article/us-china-tariff-war-and-china-s-economy-evidence-night-lights

0 Response to "what chinese goods are subject to us tariffs"

Post a Comment